BUSINESS TOOLS

A comprehensive toolkit designed to strengthen your firm

Whether you choose to utilize our entire platform or integrate specific modules into your existing system, you will elevate your wealth management capability.

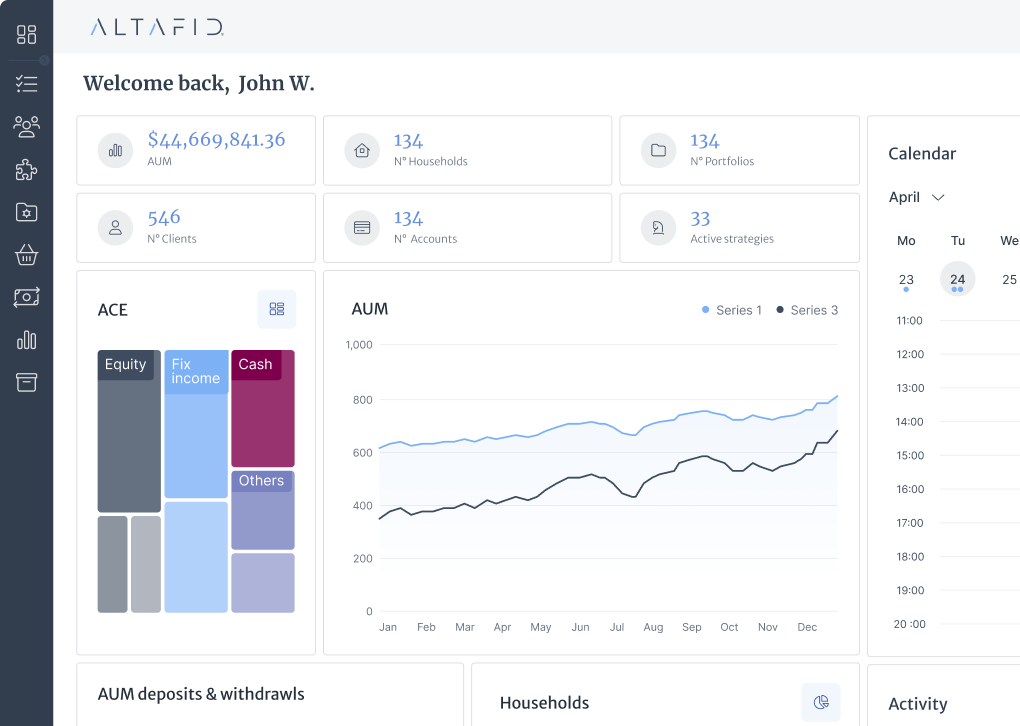

Relationship leadership

Our Contact Management feature plays a central role in developing and nurturing client relationships. By meticulously recording and associating contact details with risk profiles, households, and portfolios, advisors gain a holistic view of each client's financial situation. This enhances their understanding of client interactions with the platform and the advisory team, enabling more personalized and well-informed financial guidance.

Portfolio design

reimagined

Effectively supervising portfolios can become intricate when handling a multitude of investments. The ability to deploy diverse portfolio strategies is essential in achieving a range of objectives with distinct timelines. Regain control and streamline portfolio management through seamless allocation of portfolio models across various investment types, tailor-fitting them to meet your clients' specific goals and timeframes.

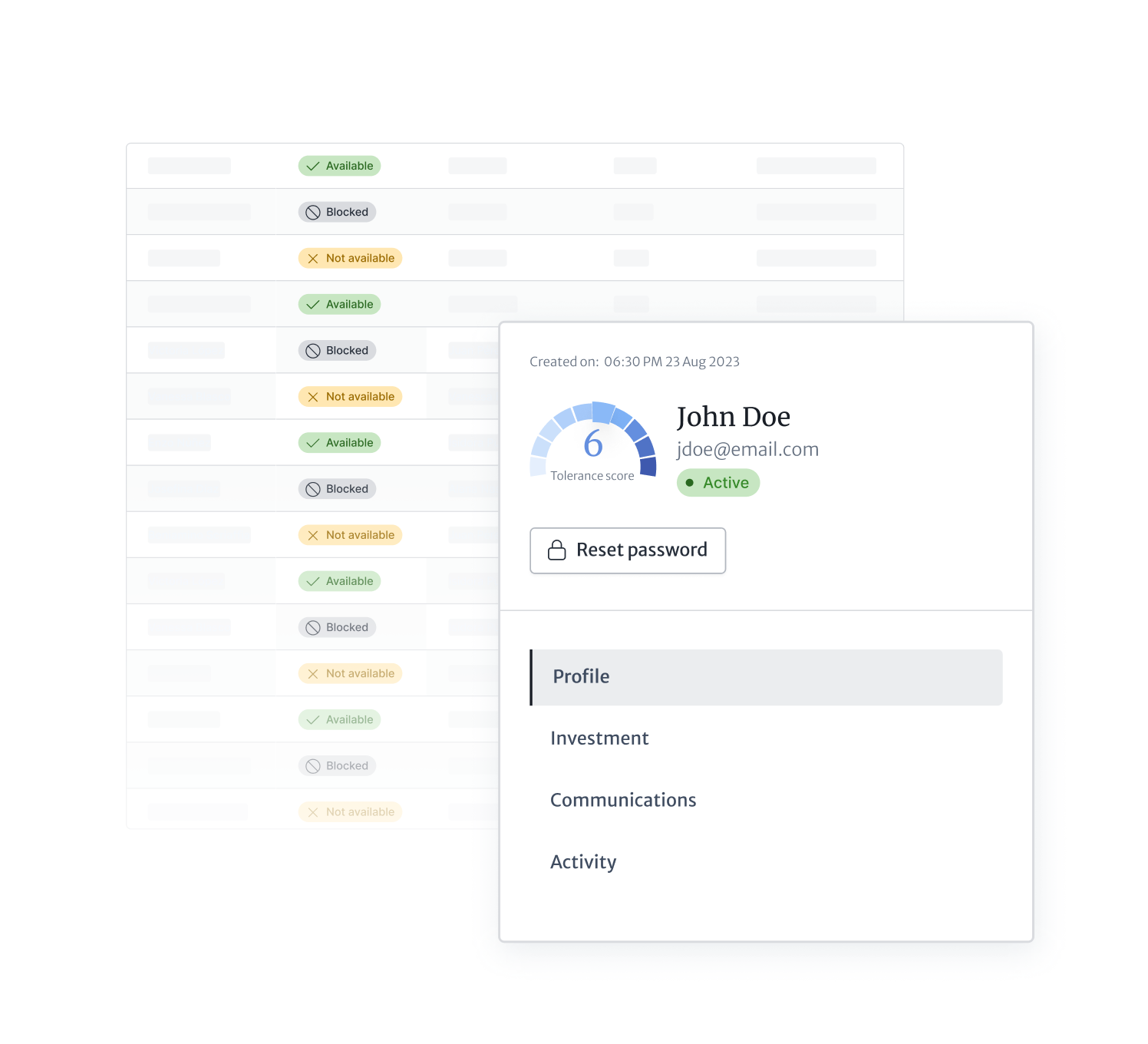

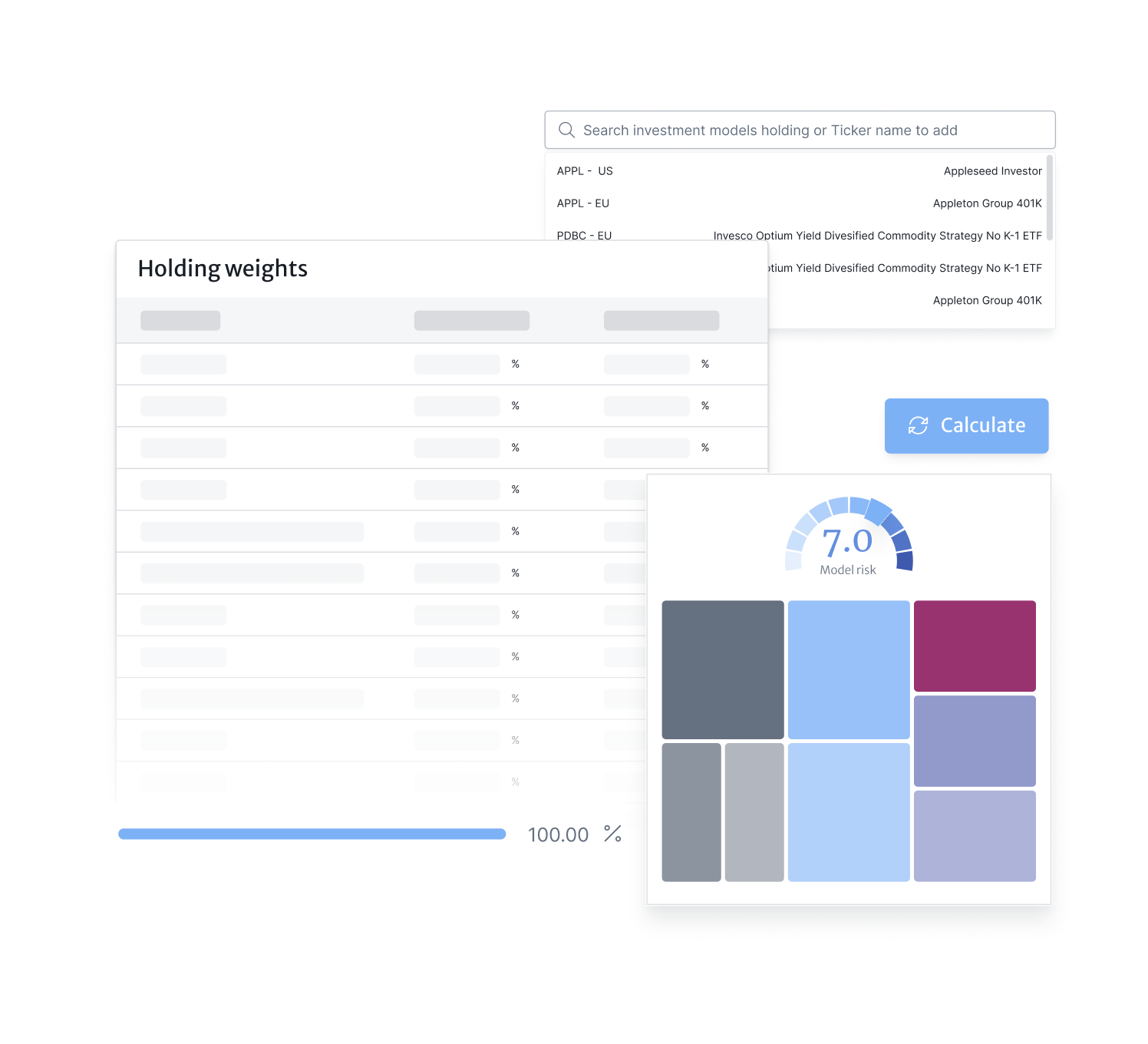

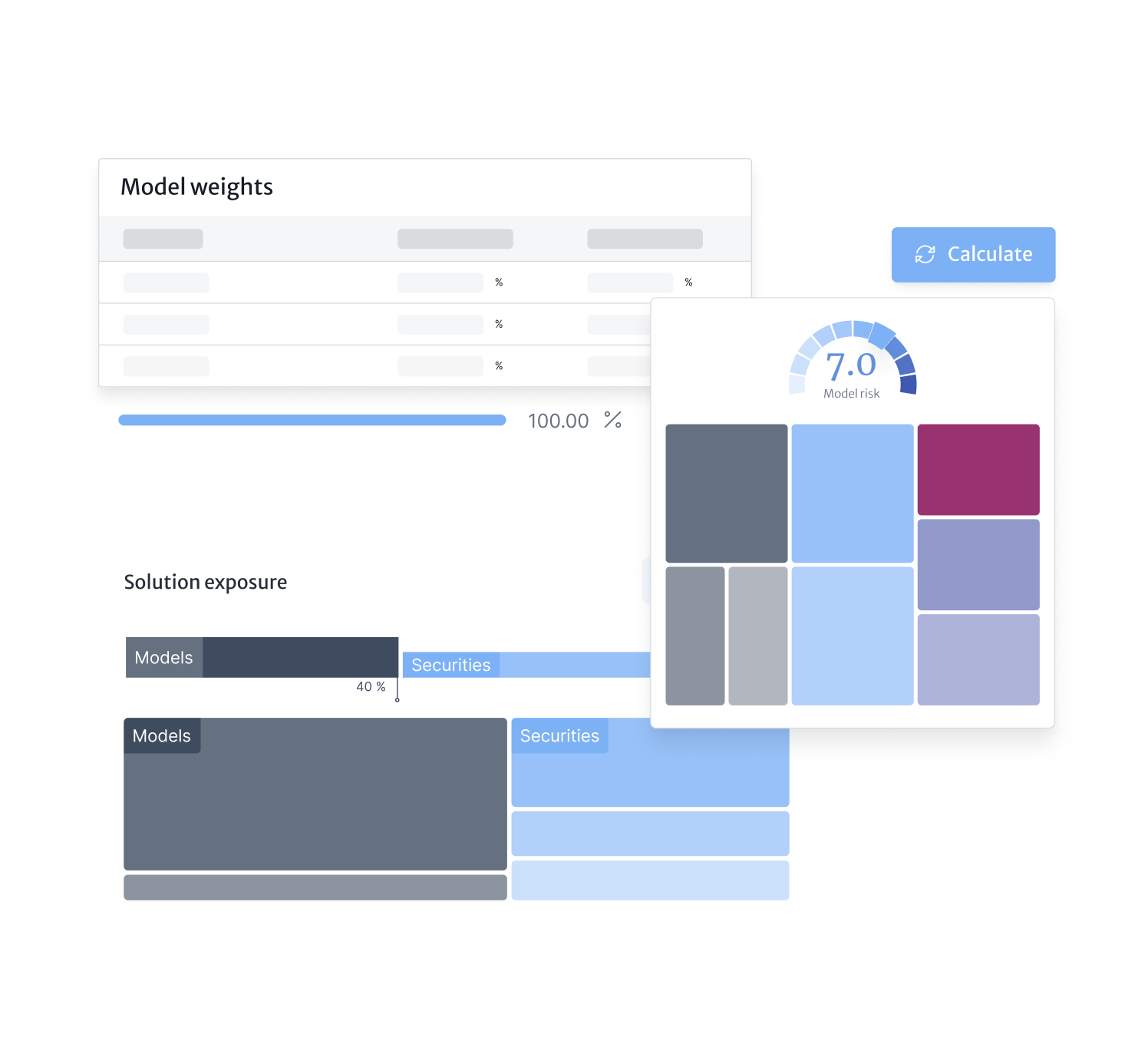

Custom investment models

Crafting tailored investment models has never been easier – with just a click, you can build custom models featuring thousands of equities. This streamlined process saves valuable time and simplifies the complex task of model creation, ensuring precision and enhancing your decision-making process. This enables you to fine-tune your models, ensuring they align with your investment objectives and risk tolerance.

Investment

solutions

Investment solutions offer the flexibility to combine models effortlessly, facilitating an integration that accurately reflects the distinct asset location preferences across different clients. This cohesive approach not only streamlines portfolio management but also enhances the allocation of assets, promoting a more comprehensive investment strategy.

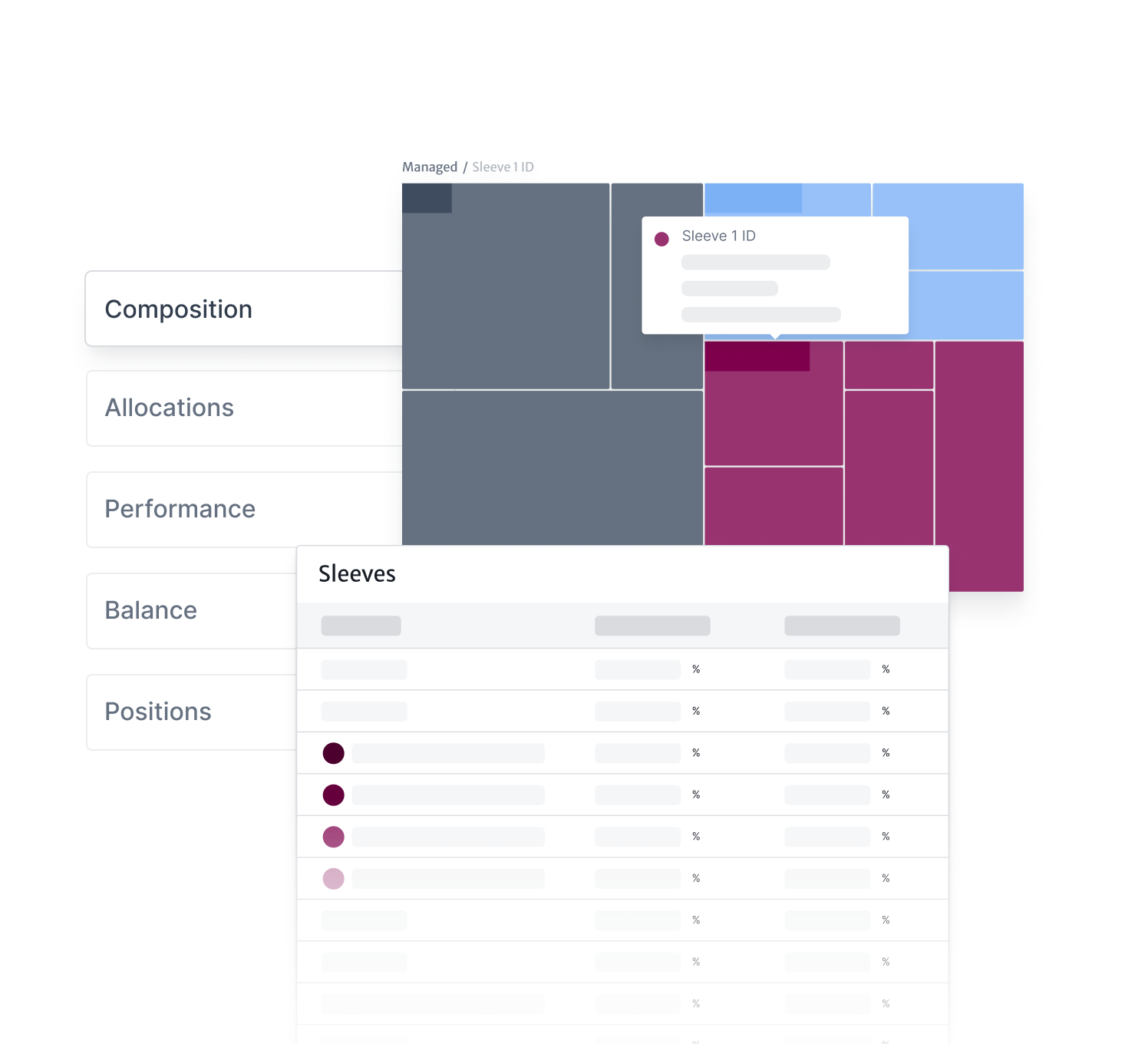

Unified managed accounts

Enhance the versatility of your investment portfolio and access comprehensive strategy-level reporting while simultaneously reducing account fees and simplifying management. This seamless, efficient process is made possible through our Unified Managed Accounts (UMA) technology. UMAs offer detailed reporting at the strategy level, providing you with a comprehensive view of your investment performance, allowing for informed decisions.

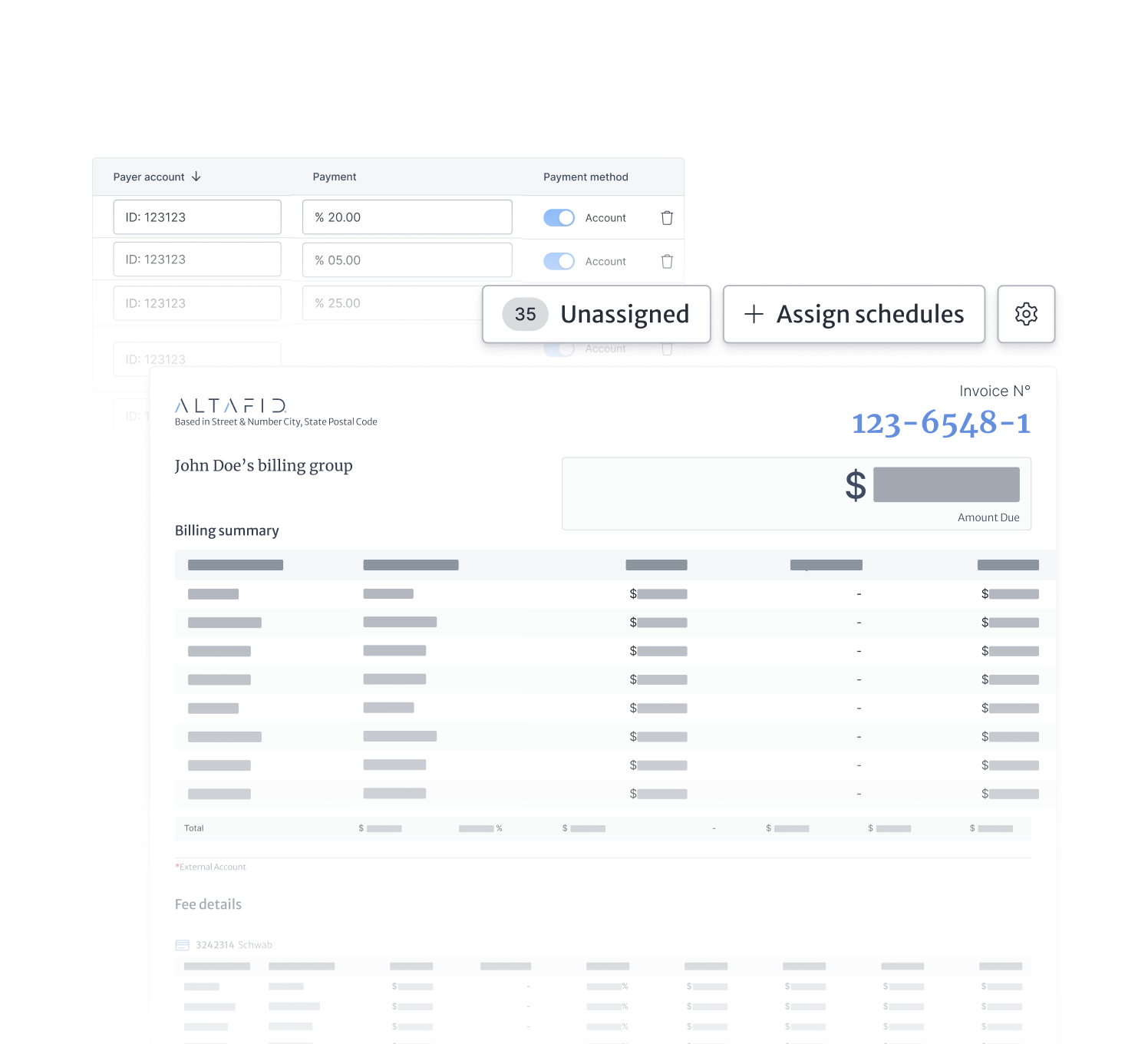

Billing center

Our adaptable client billing solution is expertly designed to centralize and simplify billing processes across your company. It caters to various levels of complexity, ensuring efficient and tailored billing operations. Whether you're dealing with straightforward or intricate billing requirements, our versatile client billing solution is the ideal choice for addressing the diverse billing needs of your wealth management firm.

Risk assessment

Our risk management system plays a pivotal role in ensuring that portfolio goals are aligned with the most suitable investment strategies. This comprehensive system continuously monitors risk factors across individuals, portfolios, and the underlying holdings. It also equips financial advisors with the capability to promptly modify investments should they veer away from the desired risk tolerance levels. In addition, our system provides regular alerts to advisors when updates to client risk profiles are necessary. By employing this system, we ensure that investment strategies are finely tuned to match individual risk tolerances while maintaining a proactive approach to risk management.

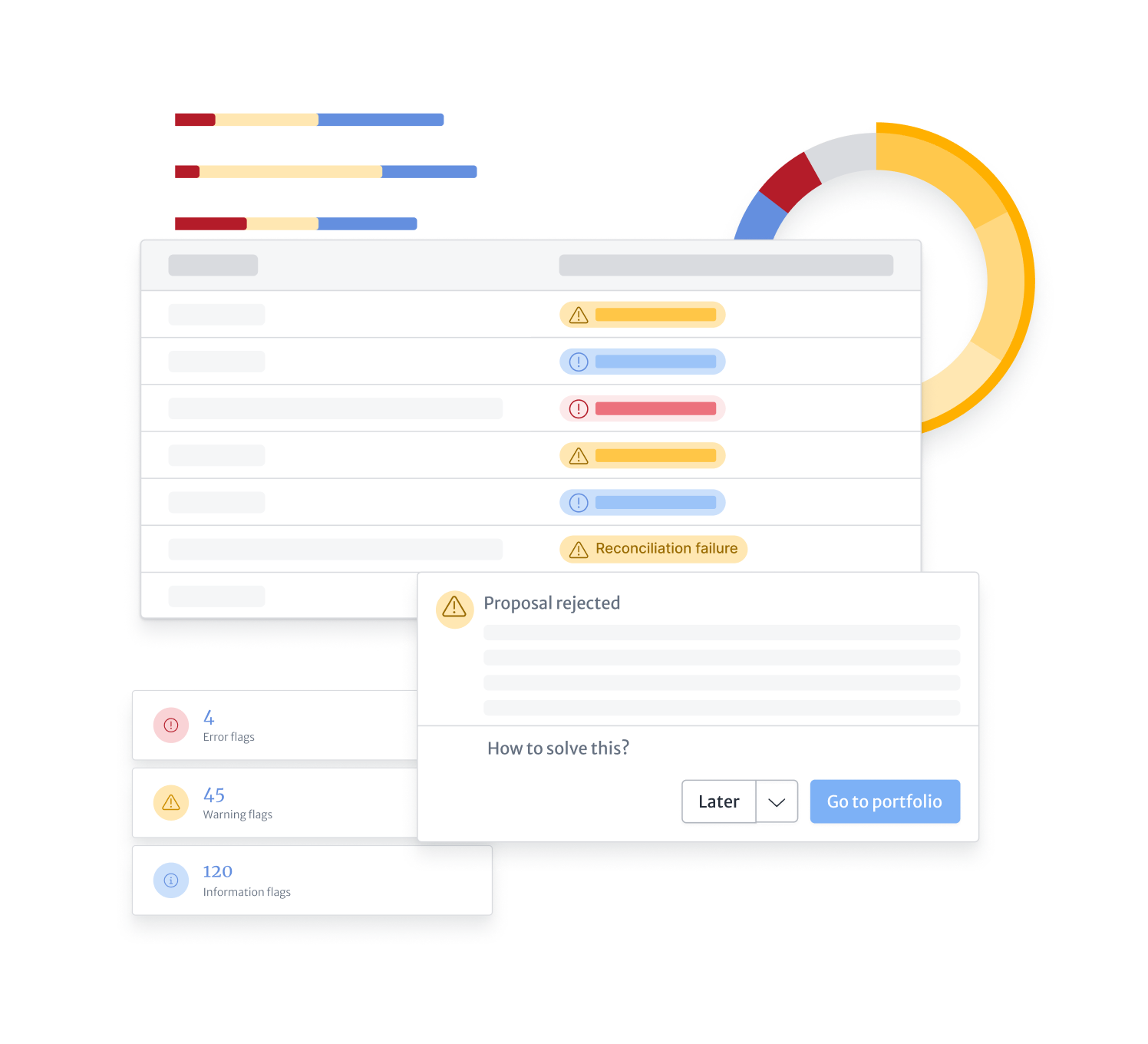

Business monitor

Our Business Monitor system provides real-time notifications to advisors whenever inefficiencies are identified. This timely alert system enables advisors to take swift and informed actions, ensuring that operations are unblocked and client funds are deployed without delay.

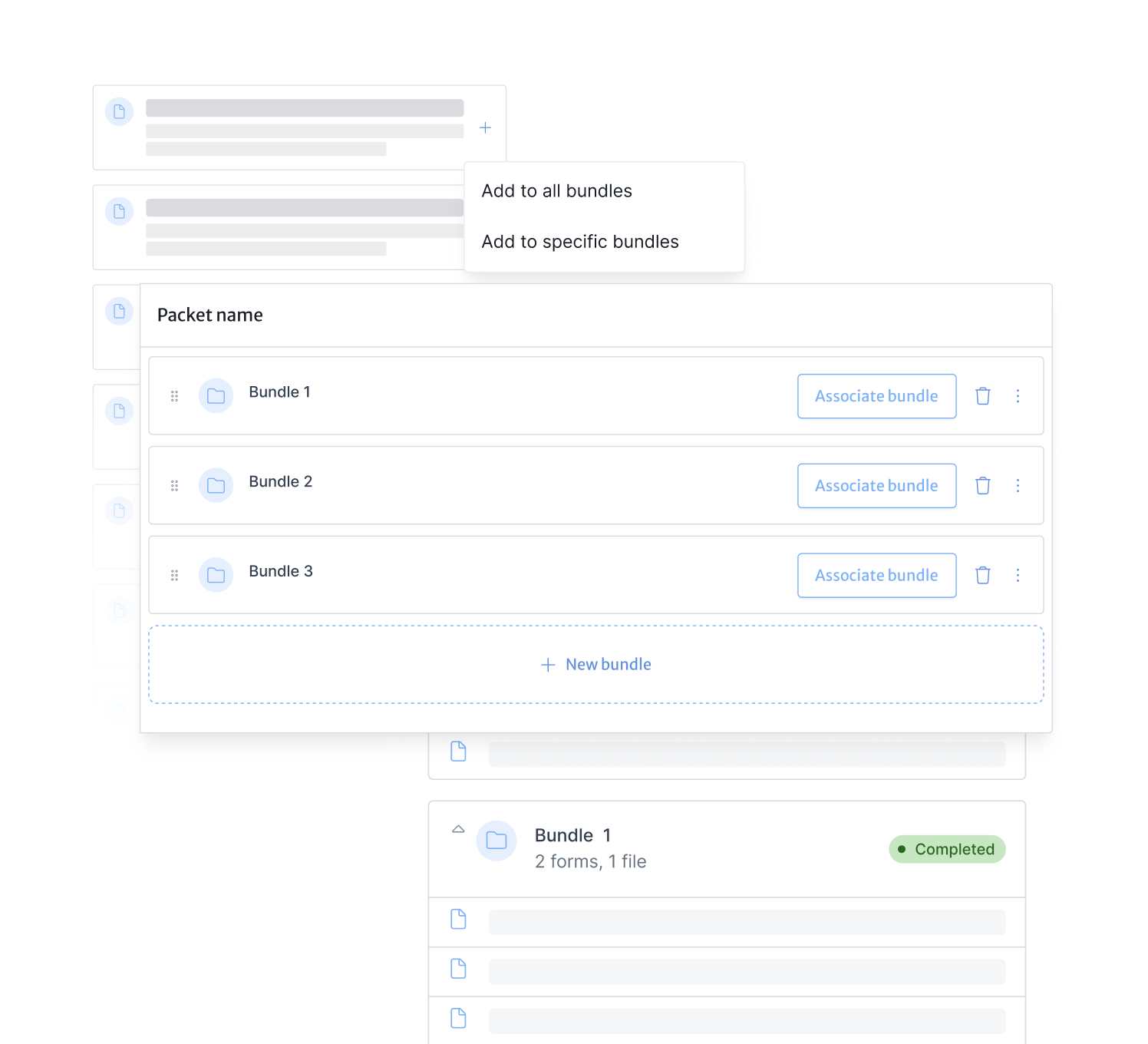

Digital forms

Improve your wealth management operations with our multi-custodial digital forms. These forms eliminate repetitive data entry and offer the convenience of bundling different forms based on business needs. With a simple click, you can seamlessly complete required forms for account openings, portfolio changes, and other business needs. Digital forms simplify data capture and form completion, ultimately improving the client onboarding and overall experience.

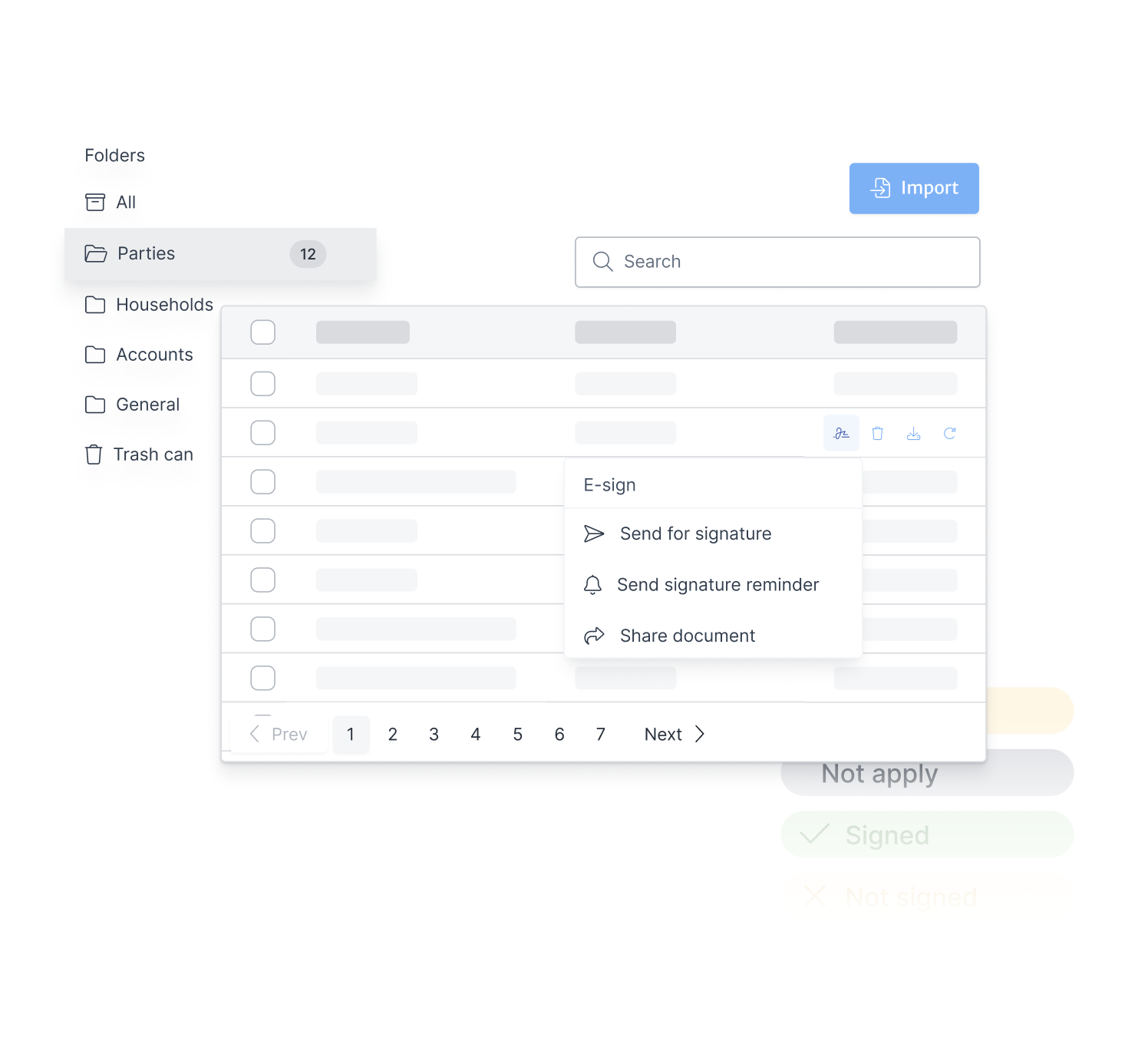

Compliance locker

The Compliance Locker acts as a secure and centralized repository for critical data. This solution excels at automating the organization and storage of sensitive information, catering to the specific requirements of wealth management firms. It ensures not only the security of your client data but also its systematic organization, facilitating easy access when necessary. This holistic approach also simplifies operational processes, reducing unnecessary overhead.

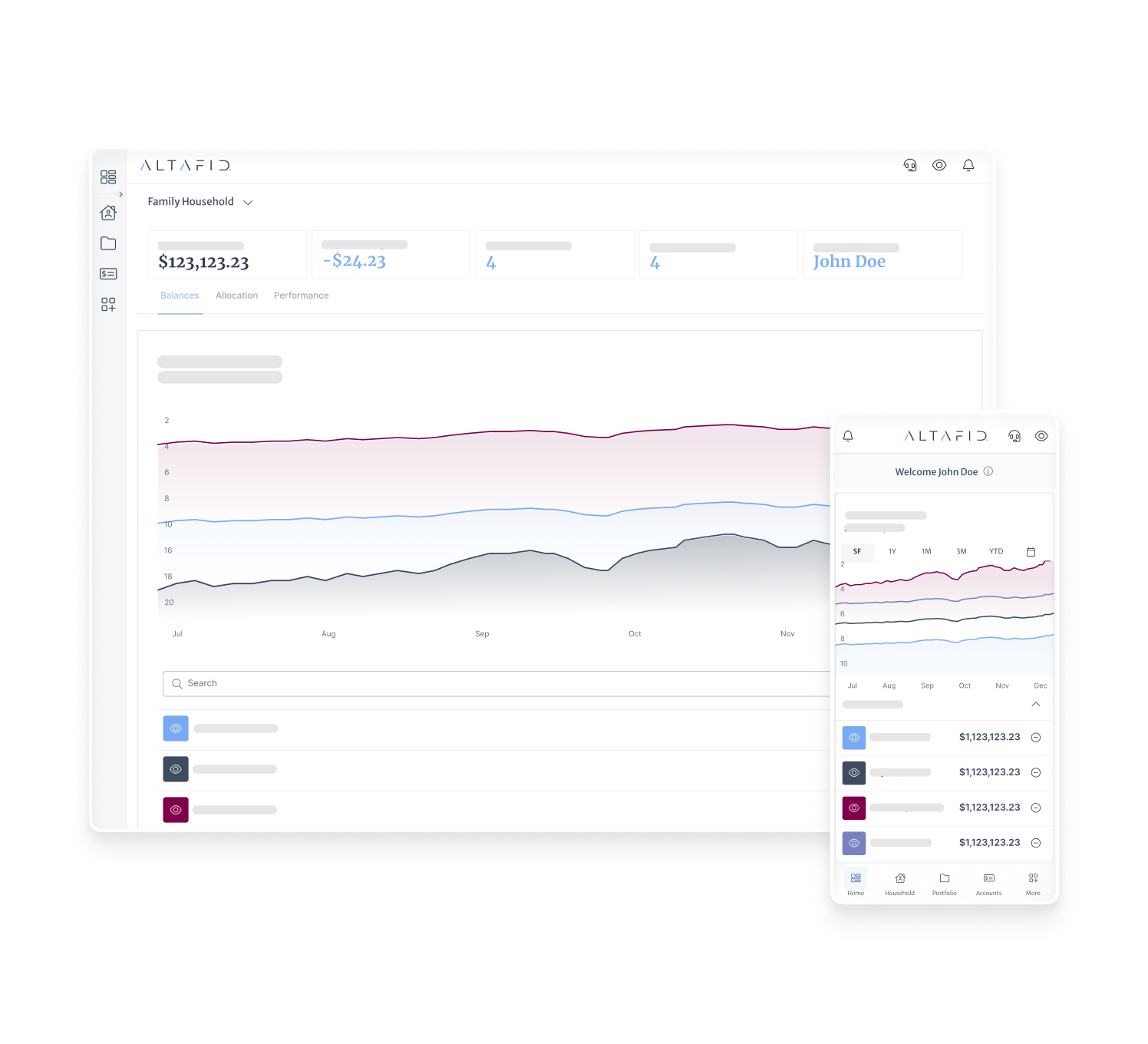

Client portal

Our client portal offers significant advantage, particularly in three key areas: tailoring client views, providing comprehensive portfolio data, and ensuring user-friendly functionality. The ability to configure client views enables personalized experiences, fostering deeper client engagement and trust. Additionally, access to in-depth portfolio data ensures that clients have the necessary insights for informed decision-making, enhancing their financial success. The ease of use of such a portal simplifies client interactions, streamlining communication and collaboration between clients and advisors, ultimately improving overall operational efficiency and client satisfaction.

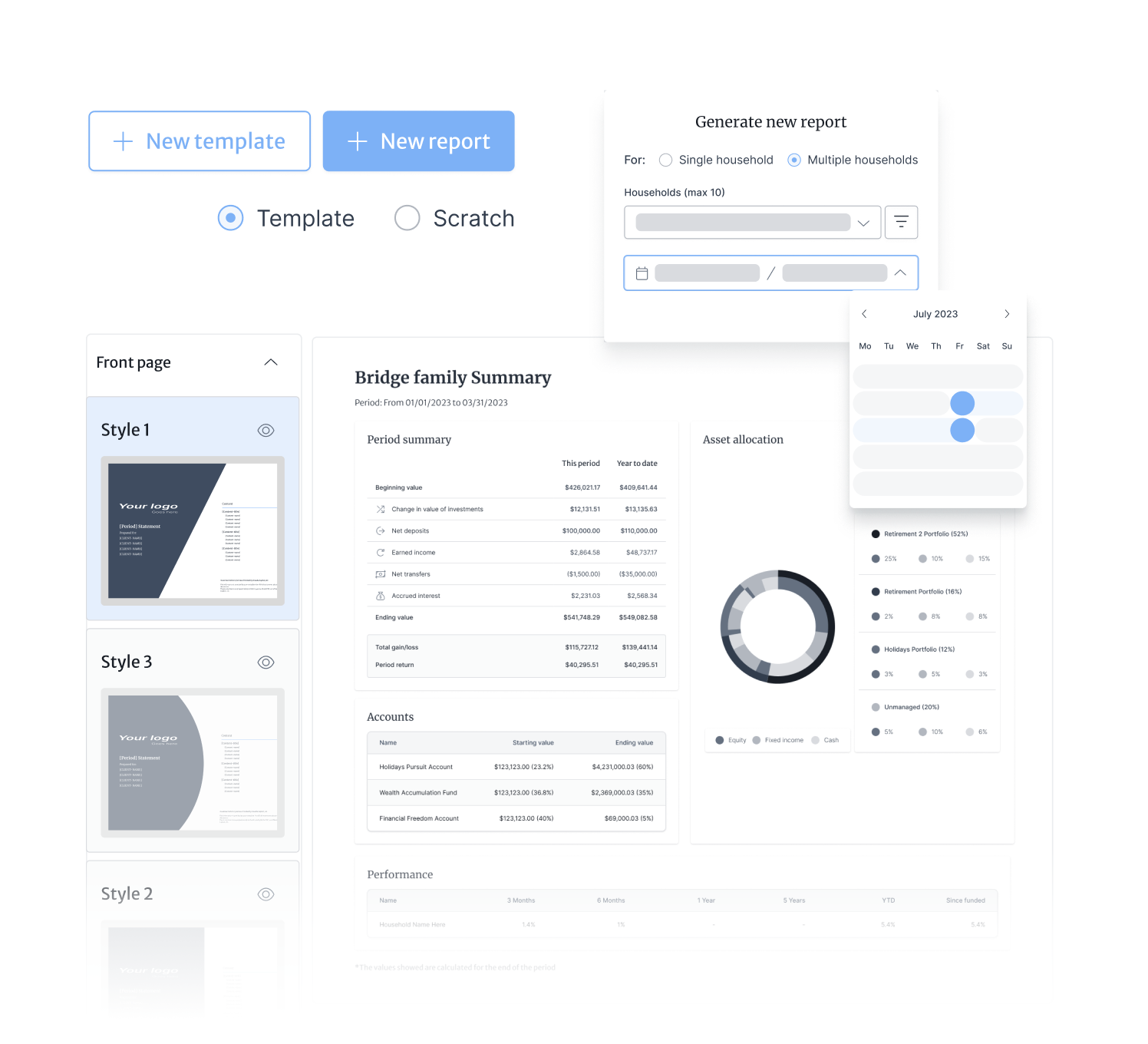

Custom reporting

Cultivate transparency and client trust with our comprehensive reporting platform. Efficiently produce a diverse range of reports covering your entire portfolio, allowing you to provide an enhanced level of transparency to your clients. This equips them with essential information to make informed decisions, streamlining the delivery of vital insights for their financial success. For wealth management firms, this transparency and data-driven decision-making are invaluable in building strong client relationships, boosting client confidence, and ultimately enhancing the overall effectiveness of your services.

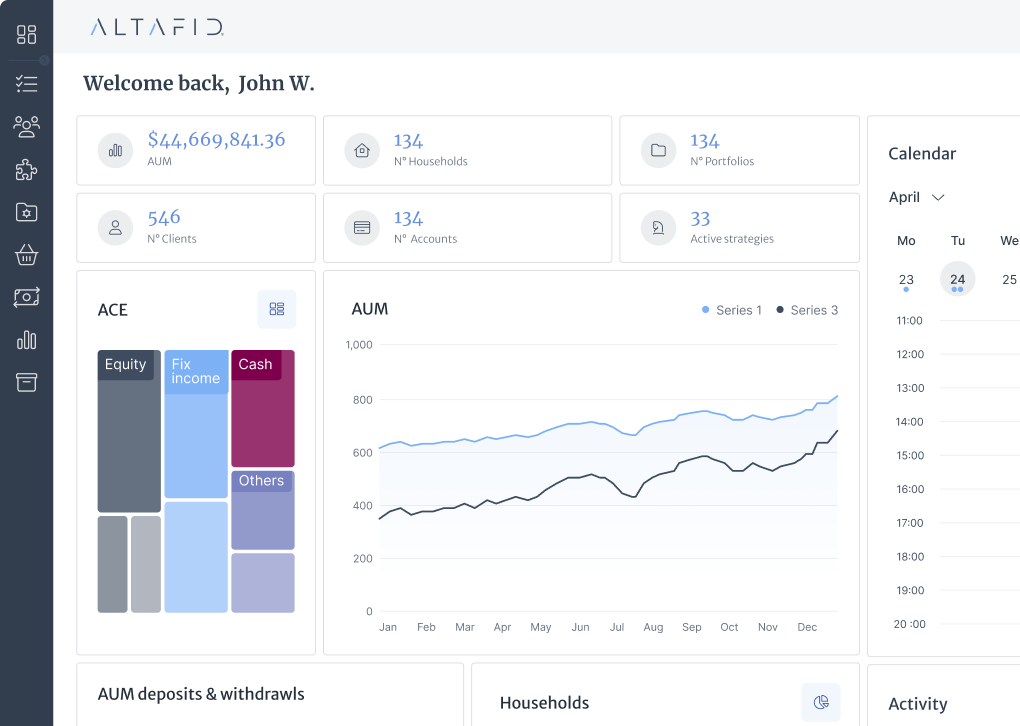

Analytics dashboards

Harness the capabilities of dashboards for a thorough evaluation of various aspects of your firm's operations, covering billing, portfolio performance, and back-office procedures. This versatile tool serves as a gateway to invaluable insights that hold the potential to drive both growth and efficiency within your firm, all powered by our analytics engine.

SUPERCHARGE YOUR BUSINESS

Schedule a full demo and discover how we help deliver better solutions